My 2023

Prizefighter – August 2023

My 2022

NAB 2017: How Digital TV Hobbyists Go Pro

This article was originally published in AdExchanger.

As someone who works in online video, the National Association of Broadcasters (NAB) convention – which starts Saturday – always felt like the show of the titans.

As someone who works in online video, the National Association of Broadcasters (NAB) convention – which starts Saturday – always felt like the show of the titans.

When digital video companies started to emerge at the conference about 10 to 15 years ago as the “disruptors,” they were no more than the industry’s “hobby,” to borrow the phrase Steve Jobs used to describe what Apple TV is for Apple.

But any hobbyist getting enough eyeballs, funding and buzz will eventually go pro. The titans of TV distribution are much bigger and they are destined to rule the world, at least in my opinion, for many years to come.

However, the landscape is changing constantly as digital delivery takes center stage.

The Hype: Big Data And Artificial Intelligence

At some point in the future, most TV will be IP-based. This will pave the way for the next milestone: TV advertising will be completely addressable, allowing marketers to do the type of targeted advertising available on web and mobile, at scale. TV is still, and will continue to be, the biggest game in town.

From its early days, TV distinguished itself by relying on data. TV was always about the numbers, and it did an amazing job making TV advertising and ratings seem like a form of science. It was a great story to tell at the upfronts. However, TV analytics are far from perfect. The actual numbers and the insights provided were and remain somewhat vague.

Then came digital advertising. With all its challenges, this is how our ads are going to be sold and tracked in the future. There are still challenges, but it has the potential to offer much better tools down the road. The TV industry gets it, so much of NAB 2017 will focus on big data, actionable analytics and some form of artificial intelligence.

We see signs of that in the market. When it comes to advertising, Roku is now offering “demographic guarantees” based on its own measurement and Nielsen Digital Ad Ratings. Dish is also getting better at targeted advertising with its Sling TV offering, using Adobe’s Media Optimizer.

It is also interesting to see companies that traditionally offered mostly secured video players now turn to analytics for their future growth. Verimatrix did that about two years ago, and Viaccess-Orca is also moving in the same direction. The key question is how to make these insights actionable. For example, Nice People at Work, which historically tracked quality of service for OTT providers, now wants to use the same technology to predict which viewers are not happy with their OTT service and may be a churn risk.

Finally, Nielsen now claims it can take all of its big data and offer marketers automated campaign optimization based on patent-pending artificial intelligence. Monitoring an ad campaign is notoriously hard for both publishers and marketers, so the ability to let machines do it for them sounds almost too good to be true, but this is the future of TV advertising.

The Face-Off: Amazon, Google And Facebook

Amazon has always had a strong presence at NAB with Amazon Web Services, Amazon Fire and Elemental. As another sign of TV and tech convergence, Google and Facebook will also have a big presence on the show floor this year, with all of them at the entrance of the South Upper Hall.

Facebook’s entire presence will focus on Facebook Live, featuring live technology vendors in a single pavilion. Google, being Google, will likely focus on multiple sides of its TV business: the Android TV platform, DFP’s server-side insertion, which is key for OTT advertising, and maybe even YouTube’s skinny bundle that launched earlier this year.

This is just the tip of the iceberg of what will be showcased this year. If we keep in mind the big-picture trends, we will be able to see the path where it is all headed.

2017 will bring Addressable TV, Mixed Reality, Social vs Publisher Battles, Skinny Bundles and OTT Price Wars

This article was originally published in Videonet.

Those of us who track the digital video industry closely (or any industry for that matter), know the feeling of going through endless news pieces and reports, trying to find a pattern that will reveal where the industry is headed. The truth is that this is hard to do on a daily basis. There’s simply too much information. However, the end of the year is a great time to take a pause, review the main news that came out this year and try to conclude which trends will gain more momentum in 2017. Here are my top five predictions.

The Year of Skinny Bundles

2017 is going to be crucial for taking the core TV experience over the top. In previous years we saw more content become available online, mostly in the US and the UK, as part of standalone apps (HBO, CBS, Showtime in the US and DisneyLife in the UK), but the TV experience as a whole (think zapping between hundreds of live channels with one DVR to record them all) remained very much behind the traditional walls of cable and satellite TV.

2017 is going to be crucial for taking the core TV experience over the top. In previous years we saw more content become available online, mostly in the US and the UK, as part of standalone apps (HBO, CBS, Showtime in the US and DisneyLife in the UK), but the TV experience as a whole (think zapping between hundreds of live channels with one DVR to record them all) remained very much behind the traditional walls of cable and satellite TV.

This is changing.

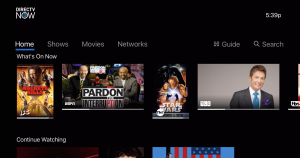

SlingTV in the US and Sky Now in the UK had been the industry outliers but they were recently joined by services from Sony, DirecTV and soon Hulu. Even Comcast, the Goliath of cable TV in the US, is toying with the idea and perhaps even Amazon in some capacity.

What is the basic premise of a skinny bundle? 50-150 live channels for about half of the price of cable, running on top of consumer set-top boxes such as Roku and AppleTV. Subscribing and terminating the service is easy. And the experience is pretty close to TV (if you can live with the occasional buffering). In 2017 we will see this experience getting even better with the addition of Cloud DVR to some of these services – and probably a healthy price war that will make this even more appealing to consumers.

Addressable TV is Here

There are two undeniable (and somewhat conflicting) truths about TV advertising: a) it’s flawed, and b) it delivers results and scale like no other medium. But TV advertising is about to get much better. How do I know? Because over the last year I found myself clicking on at least five “suggested posts” in my feed. Two to three times I even bought something. I can’t recall ever doing that before. So what’s the connection between TV advertising and how display ads are becoming better targeted? Addressable TV.

The notion of being able to serve personalised ads in TV pods has existed for a long time, but the infrastructure was never there. Broadcast TV was always too, well… “broad” to be able to serve each household specific ads based on the online behaviour and consumption patterns of the family. However, as more TV services become IP-based, we can a see path to improve TV advertising.

To date, addressable TV was only present in about 3% of the US market, but next year AT&T is planning to sell targeted ads via Direct TV Now. In addition, Facebook’s Audience Network is testing ad delivery in TV apps running on Roku and AppleTV. If Facebook can do as good of a job on the big screen as it does on mobile and web it will have a bright 2017.

OTT Price War

In 2016 Netflix was finally challenged by other OTT providers, mainly Amazon, who rolled out its video service in 200 countries. Netflix is well positioned to continue to dominate based on its powerful brand and wildly successful original programming strategy (Netflix got the third most Emmy nominees this year; last year it was only placed sixth).

In 2016 Netflix was finally challenged by other OTT providers, mainly Amazon, who rolled out its video service in 200 countries. Netflix is well positioned to continue to dominate based on its powerful brand and wildly successful original programming strategy (Netflix got the third most Emmy nominees this year; last year it was only placed sixth).

But Amazon is making Netflix sweat a little. First, it rolled out a download feature way before Netflix. And it also started acquiring and producing great content. The next stage in this war is a game that Amazon plays better than almost any company in the world – undercutting the competition. Amazon’s Prime Video launched globally this year, offering the service for $2.99. After an introductory period the price goes up to $5.99, still well below Netflix $9.99 HD plan.

Another indication that prices may be shifting came lately from HBO. At $15/month HBO Now is still the most expensive OTT service, but in some skinny bundles it is now offered for $5. Given that the service adoption has been relatively slow (estimated around 1M in the US), Time Warner and its likely new owner, AT&T, may be willing to give away their premium content for a little less. What will Netflix do then?

The Battle of Social versus Publishers

All social networks and apps are putting extra focus on video. And it shows. In 2016, Facebook launched the highly talked-about Facebook Live feature and as a result it has seen 88% growth in video posts. Twitter streamed NFL games with viewership of about 500K at any given moment and Snapchat is making moves to add more video via its Discovery feature.

With these latest moves, media companies are worried about social apps evolving and becoming competitors for eyeballs rather than another distribution platform to drive viewership and ad revenue for them. In that respect, it is interesting to see how cautious YouTube has been about making a push for original content. YouTube’s strategy is now focused on building the most innovative tools (they recently launched 4K live streaming for 2D and 360 video) for brands and media companies so they continue to upload more content to YouTube. Since Facebook and Snapchat need to grow their revenue much faster than YouTube, they may not be as restrained.

VR Will Grow, MR Will Go Mainstream

The next iPhone launch will be even more festive than usual as Apple marks the 10th anniversary of the device that has changed the world and made Apple the most valuable company on the planet. The iPhone 8 will need to deliver something really spectacular and that thing may be a new Mixed Reality and Virtual Reality technology.

The next iPhone launch will be even more festive than usual as Apple marks the 10th anniversary of the device that has changed the world and made Apple the most valuable company on the planet. The iPhone 8 will need to deliver something really spectacular and that thing may be a new Mixed Reality and Virtual Reality technology.

According to some industry experts, like Robert Scoble, Apple will also launch a new Apple TV and iPad that will change how we use video and interact with the world. In addition, 2017 may be the year in which we finally get to judge for ourselves if the mixed reality headset that Magic Leap has been working on is as great as all the initial reviews by the tech geeks who have had a sneak peak. Those technologies, along with Google’s DayDream and Samsung’s GearVR, will make video in VR even more exciting and valuable in ways that we are only now starting to realise.